In this modern world where technology has begun to develop on a daily basis. The world took a step forward to new financial technology by innovating new platforms which never taken place in front of people. This technology started to gain novelty.

Before, customers had to visit financial institutions like banks and others for the work done. People use it to limit their money usage. But now, with the help of fintech, there is a wide scope and more opportunities for customers. Fintech offers top service with no extra charges.

Now the question that should seek our attention is, how is this technology working?

Thus, today in this article, we will draw our attention towards FinTech.

What Do You Understand By The Term Fintech?

FinTech is also known as financial technology. It is an improved and innovative way of traditional financial methods. The technology used to take finance activities a notch higher.

Fintech makes financial service easy and seamless. The world is using fintech for easy and convenient accounting, payment processing, and e-commerce. Now you can pay bills, online deposit checks, and transfer money at your pace.

Why Choose Fintech?

Companies are hiring the best fintech service development firms. That can make complex work look seamless in this lucrative market, before the work that took so many hours for extracting information, is now done within seconds.

This is an achievement for the company. Investors are opting fintech industry. 47% of investors want to invest in this after financial services.

In 2018, the global fintech market was worth USD 127.66 billion, and we expect to be USD 309.98 billion by 2023.

From a report, we found that customers show interest and trust in using such technologies. Around 75% of people have used fintech transfer, and 96% of them have heard about it.

There are many Top Fintech Companies In India like B2C Fintech Startups. Now we include this in Top-notch finance app development.

The history of FinTech and how it evolved

A report by Arneris, Barberis & Ross tells the evolution of fintech in four timelines.

FINTECH1.0 talks about the time when we send financial information via telegraph. In the 1950s, credit cards were set in motion for cashless transactions. It lasted from 1886 to 1967.

FINTECH2.0 came into existence in 1967 and lasted till 2008. The launch of the first calculator was in this era, and the first ATM was in 1967. Thereafter SWIFT, well known as a society for worldwide interbank financial telecommunications established. This worked for large volume payments.

This era gained popularity for online payments that widened with e-commerce and the internet.

Then in 2008 came FINTECH3.0, which is still in the market. In 2009 a new era of this industry came forward with the launch of bitcoin v0.1. Many cryptocurrencies launched afterward, followed by the biggest crash in 2018. The growth of the fintech industry continued after many people accessed the internet. Then we saw the coming of google wallet in 2011, come after apple pay, 2014.

After FINTECH3.0, FINTECH 3.5 came into existence and is present till now. This new era is adopting fintech while creating new market opportunities. In the market, India and China are at the top using fintech. Come after Brazil, the UK, and Australia.

Most of the population is shifting from traditional banking and moving towards the latest technology, fintech.

Click Below to learn the basics of Fintech and it Uses

Click Below to learn the basics of Fintech and it Uses

Contact Us

Drastic Turn Towards Fintech Products?

There are some reasons why customers seem super excited about choosing fintech products.

1. Money Related Changes

Imagine a world where we share smart and smarter money. In FINTECH, we’re making some changes to bank accounts–starting with new transactions and variable rates that grow smarter with you. This is just the beginning of a new world of online banking.

Money Management Is Now A Choice.

- Customers got many choices in money management as fintech institutions took this game a notch higher by making a place in the tech market. They made the transaction easier for people living in remote areas so that people could manage their money from the comfort of home in a low-cost range. This industry is still adding new features to meet customer demand.

Money Transfers Are Faster And Cheaper.

- Do you live in another country and transfer the money to your loved ones daily? Then without being aware, you are paying a huge amount to the company as transaction charges.

- Still, by using fintech, you save money on money transfers using various apps and earn a chance to use blockchain infrastructure for paying in Fintech Startups India.

2. Advisory And Technology-related Changes

Fintech is quickly changing, and so are the advisory rules and regulations that govern it. Established fintech companies and start-ups alike must be knowledgeable about the rules or face serious consequences.

Getting Your Financial Advisor

- Various apps are available in the market that helps you track your transactions. These apps also suggest plans according to people buying behavior. These apps make a record of your income and expenses hence helping you track and save more than before.

Go Digital

- Now you can go cashless pay by your bank with the help of the fintech industry. Digital payment providers play a major role in the Fintech Companies India. Many other countries use digital payment methods, including browser-based or in-app online purchases. The Fintech Startup company has already changed our views on handling money. You can transfer money in no time.

Pay Using Bitcoins

- Pay using cryptocurrencies using a virtual wallet. Big companies like Dell, Expedia, subway accept payments via bitcoins. These work on a technology named blockchain technology that makes money transfer using bitcoins easy.

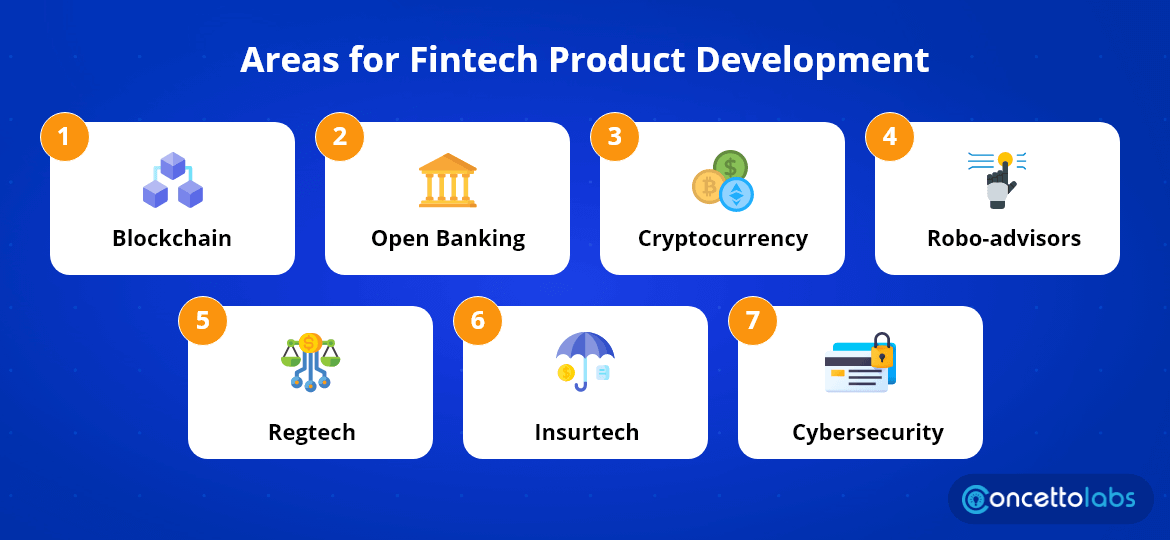

Areas For Fintech Product Development?

Types of fintech. There are many Fintech applications like,

1. Bank And Finance

We’re dedicated to not just giving you the best rates and tools but also empowering you to make better financial decisions for your family.

That’s why our fintech solution addresses all your needs under one roof – including features like blockchain, open banking, cryptocurrency, etc. It is time to take your finances into your own hands.

Blockchain

- Blockchain technology in the fintech industry is revolutionizing. As the name suggests, blockchains are blocks in a chain, long chains. The information in these blocks unrolls along with the entire network.

- So, hacking a single block won’t provide you with any crucial information unless you got all pieces. It works by arranging all blocks in an orderly manner, which is important to get accurate details. IoT operating systems, smart contracts, NFT marketplaces, and cryptocurrency work on this tech.

Open Banking

- It is a system where third-party financial advisors are providing access to your financial and personal data: paperless check deposits, cash management systems, and personal financial advisor applications all work on this framework.

- Some applications can store card information, and customers can make payments at any time via ATMs by providing customers with a safe, simple and better environment like a bank.

Cryptocurrency

- The latest currency, crypto, originated in 2009 by a developer named Santoshi Nakamoto. The main reason the crypto market has grown over the ages is no necessity for agents in the process. These are also based on the blockchain method making it tough to hack. It makes payment easy across borders. Many investors have started using cryptocurrencies like Ethereum and bitcoin to pay.

2. Advisory And Consultancy

It’s time for a change. Don’t believe the marketing spin. Today’s most disruptive industry is always tomorrow’s mainstream product. If you’re ready to lead the charge, it’s time to consider a fintech customer experience partner that can help your business grow.

Robo-advisors

- These are financial advisors who take care of investments and provide you with money advice based on buying trends and goals. They use data from your debit, credit, and bank account transactions to know your financial behavior. They also encourage more savings.

Regtech

- Also known as regulatory technology is a completely new concept. This helps investors and their businesses act under regulations and protect them from penalties. Sometimes investors can’t keep track of all activities. Using advanced technology helps against the chance of risk by increasing accuracy.

- Now businesses can unbolt new chances without settling on business regulations.

3. Insurance And Security

Every industry evolves, and our mission is to ensure better security for everyone. We introduce new changes in fintech to help grow with the changing times.

Insurtech

- It is a combination of technology and insurance. The insurance sector has evolved from investing and collecting money to present bundled insurance with excellent returns. Over the last few decades, mathematicians used to calculate the risk. But now, with AI, we can assess these numbers in seconds with more and more clarity. Now we can track data from all sources and get the correct number. This can be used in the Health and finance Mobile App, which can provide the companies to know what was the health condition of the user before securing insurance.

Cybersecurity

- Cybersecurity unites with the key. Where there is development, there is a risk of cyber-attack, which is not good for any company. Large banks do not afford to lose customers due to security issues. Security risks can be in any form, spoofing, money laundering, malware attacks, etc. We can resolve these by adopting cybersecurity tech.

Conclusion

This industry has a bright future filled with many opportunities. Still, many new technologies are coming in. The technology can also be used in a finance app development company. Making use of FinTech, we can commercialize the application to bring in business.

We also provide FinTech App Development. Get in touch with us for the development of different applications and websites for your business and give a boost to it.

Are you in search of Fintech Introduction?

We can help with Fintech app development and its uses

Contact us today!

Indonesia

Indonesia

Botswana

Botswana

USA

USA

Italy

Italy

Panama

Panama

USA

USA UK

UK Saudi Arabia

Saudi Arabia Norway

Norway India

India Australia

Australia